Navigating the Digital Noise: How to Choose the Best Social Media Agency for Your Business

98 ViewsIn the fast-paced digital landscape of 2026, social media has evolved from a simple networking tool into a sophisticated marketplace and a primary customer service channel. In most of the businesses, it is no longer whether they are required to be present on these platforms, but how they canContinue Reading

What Makes a Franchise Marketing Strategy Effective?

90 ViewsFranchise owners face a tough spot. You must stick to the big brand rules from headquarters while tweaking things to fit your local crowd. Mess this up, and you risk losing money or diluting the brand’s strength. Get it right, though, and your franchise marketing strategy can drive fastContinue Reading

Choosing the Best Heavy Duty Platform Ladders for Your Workplace Requirements

204 ViewsSelecting the right access equipment is essential for maintaining a safe, functional, and efficient work environment. Whether you operate in a warehouse, logistics centre, manufacturing plant, or commercial facility, workers often need to perform tasks at elevated heights. The equipment they use must be strong enough to withstand constantContinue Reading

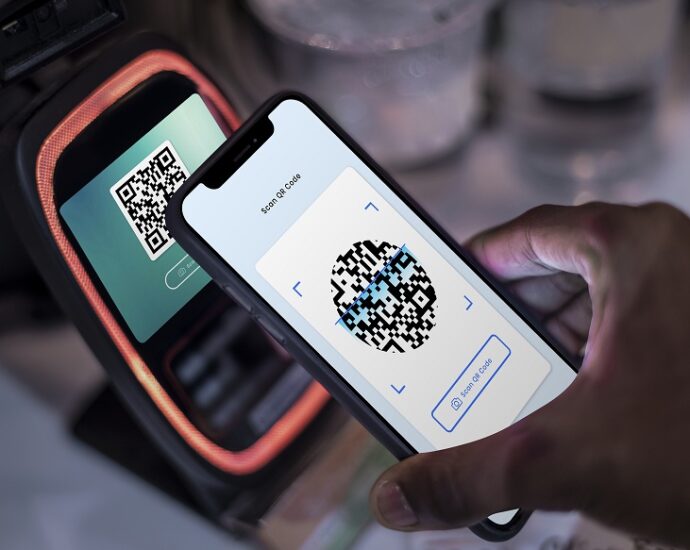

The Race for Real-Time: How Instant UPI Apps Redefined Everyday Payments

145 ViewsIndia is undergoing a digital transformation at an unprecedented pace, revolutionising how we handle everyday transactions. At the heart of this change is the Unified Payments Interface (UPI), a game-changer that has redefined notions of convenience and reliability in the financial sector. But what truly supercharges this innovation isContinue Reading

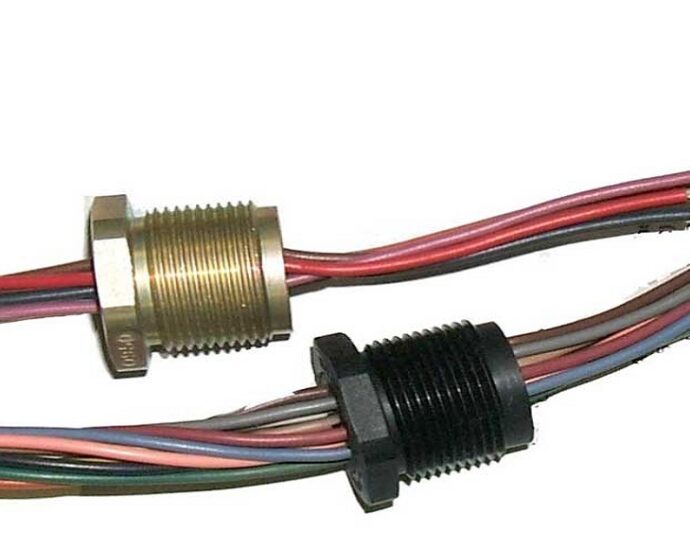

Elegant Passages: Hermetic Feedthroughs in Modern Engineering—Engaging Content Ideas for Aspiring Engineers

228 ViewsUnderstanding the niche world of hermetic feedthroughs opens a doorway into critical components that ensure safety, reliability, and innovation across advanced engineering fields. This topic is ideal for students, early-career engineers, and technical professionals looking to deepen their expertise or explore unique applications within the aerospace, medical device, energy,Continue Reading

Is Your B2B Marketing Agency Delivering a Positive ROI?

145 ViewsIn today’s competitive business landscape, every company strives to maximize their return on investment (ROI) when it comes to marketing efforts. However, when it comes to B2B marketing, the stakes are even higher. B2B companies rely on marketing agencies to help them reach their target audience and generate leadsContinue Reading

Why Agencies Are Partnering with Offshore Graphic Design Teams

151 ViewsDesign agencies face rising demands to create visually appealing work at reduced costs and faster speeds in today’s quick-paced creative environment. The current creative market requires agencies to produce digital advertisements and website graphics and branding materials and marketing materials at an unprecedented rate. Many design agencies choose toContinue Reading

5 Hidden Costs of DIY Judgment Collection – And How to Avoid Them

139 ViewsCollecting a money judgment on your own is often seen as a way to save money. Financial savings may be realized, at least initially. But if collection efforts drag on for an extended amount of time, the hidden costs of DIY collection can be devastating. Hidden costs are foundContinue Reading

How to Conduct a Communications Audit for Your Business

94 ViewsWhat Is a Communications Audit? A communications audit is a comprehensive review of how your business communicates — both internally and externally. It helps identify what’s working, what’s not, and how your messaging aligns with your brand goals. From social media and email campaigns to press releases and internalContinue Reading

Beyond Traditional Assets: How Belgium’s Experienced Traders Are Expanding Into Alternative Markets

163 ViewsBelgium has long been home to a sophisticated class of investors. Known for their prudence, strategic thinking, and deep understanding of global finance, Belgian traders have traditionally gravitated toward blue-chip stocks, government bonds, and established funds. But as markets evolve and volatility reshapes the financial landscape, even the mostContinue Reading