The rise of online share trading has made it easier than ever for individuals to participate in the stock market. Stock market apps offer a convenient way to trade, manage investments, and stay informed about market trends. However, while these apps offer numerous benefits, they also come with their own set of drawbacks. This article examines both the pros and cons of using a stock market app to help you make an informed decision.

Pros of Using a Stock Market App

Stock market apps have transformed online share trading, it have changed the way people trade and manage their investments. Here are some of the primary benefits of using these apps:

Convenience

One of the biggest advantages of a stock market app is convenience. You can access your account and trade stocks from anywhere using your smartphone or tablet. This flexibility allows you to stay connected to the market and manage your investments even when you’re away from your computer. Whether you’re at home, at work, or travelling, you can easily execute trades and check your portfolio.

Real-Time Data

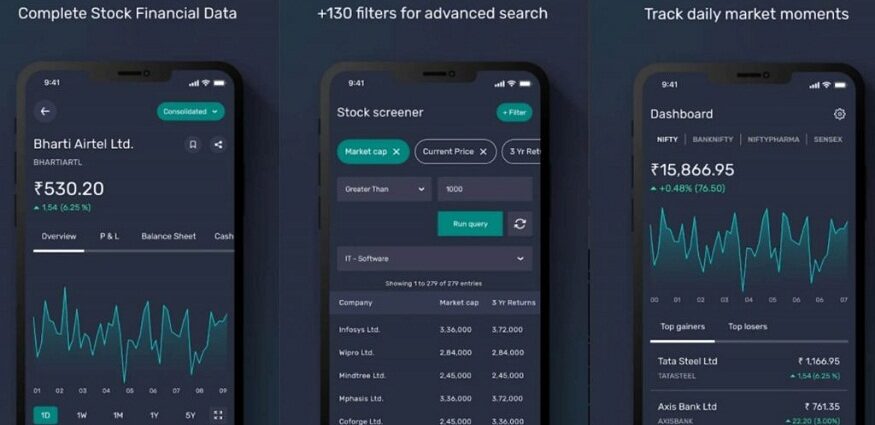

Stock market apps provide real-time data, including livestock prices, market news, and financial reports. This immediate access to information is crucial for making informed trading decisions. With real-time updates, you can respond quickly to market changes and take advantage of investment opportunities as they arise. Keeping up with the latest data helps you make timely and strategic choices.

User-Friendly Features

Many stock market apps come with user-friendly features that simplify trading and account management. These features include intuitive interfaces, easy order placement, and comprehensive portfolio tracking. A well-designed app ensures that even novice investors can understand and use its tools effectively. User-friendly apps enhance the overall trading experience by making it straightforward to execute trades and monitor investments.

Advanced Tools and Analytics

A stock market app offers advanced tools and analytics for more experienced traders. These tools may include technical indicators, charting capabilities, and in-depth market analysis. Access to these features can help you develop and implement more sophisticated trading strategies. Advanced tools provide valuable insights into market trends and can improve your decision-making process.

Cost Efficiency

Many stock market apps offer low or zero-commission trading, which can reduce the cost of investing. This cost efficiency is beneficial for both casual and frequent traders. Lower trading costs mean that more of your investment returns remain intact. Additionally, some apps offer free access to research reports and market analysis, further enhancing their cost-effectiveness.

Cons of Using a Stock Market App

While stock market apps offer many benefits, they also have some disadvantages that should be considered which are mentioned below.

Limited Personal Interaction

While apps offer a wealth of information and tools, they cannot replace the personalized guidance of a professional. This lack of direct communication can be a drawback for investors who prefer face-to-face consultations or need personalized advice.

Security Risks

Security is a significant concern when using stock market apps. Although many apps use encryption and other security measures, the risk of hacking and data breaches still exists. Protecting your account with strong passwords and enabling two-factor authentication can help mitigate these risks, but no system is entirely foolproof.

Technical Glitches

Like any technology, stock market apps are subject to technical glitches and outages. These issues can affect your ability to execute trades or access important information. While such problems are relatively rare, they can be frustrating and potentially costly if they occur during critical trading periods.

Over-Reliance on Technology

Relying solely on a stock market app can lead to over-reliance on technology. Investors might make decisions based on app data alone without considering broader market trends or seeking professional advice. It’s important to use the app as a tool rather than the sole source of investment decisions.

User Error

The ease of trading through an app can sometimes lead to user errors, such as placing incorrect orders or making mistakes in managing investments. While demat apps are designed to be user-friendly, they cannot eliminate the risk of human error. It’s essential to double-check your trades and ensure you fully understand the app’s features before making significant transactions.

Conclusion

Stock market apps offer a range of benefits, including convenience, real-time data, and user-friendly features, making online share trading more accessible. However, they also come with drawbacks such as limited personal interaction, security risks, and potential technical issues. By weighing these pros and cons, you can better decide whether a stock market app is the right tool for your trading needs and how to use it effectively for successful investing.